25+ Back end ratio calculator

Following the formula provided above back-end ratio total debt paymentsmonthly. This means you dont only include debt repayments for housing but also look at.

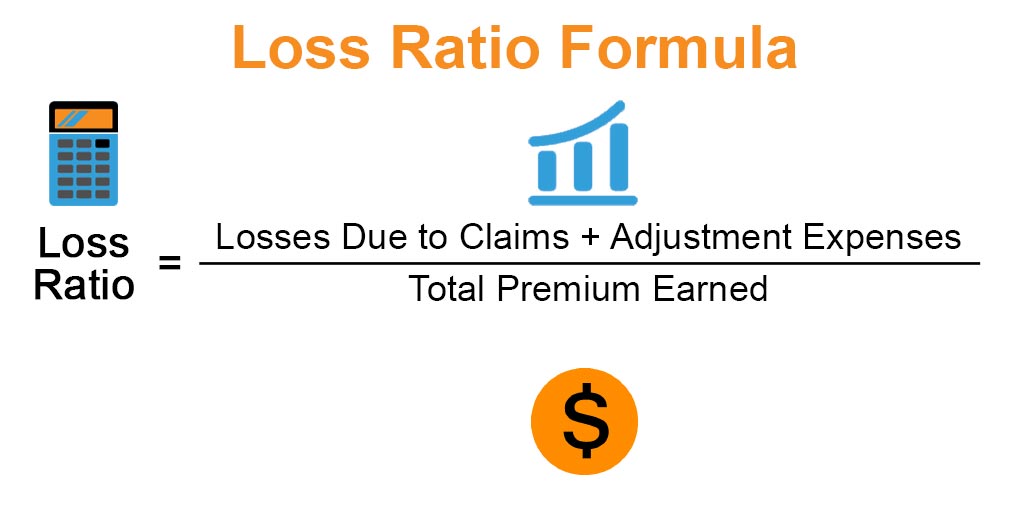

Loss Ratio Formula Calculator Example With Excel Template

In a back-end ratio your monthly debt includes credit card mortgage auto loan payments as well as child support and other loan obligations.

. Lets look at an example. Generally speaking a debt ratio greater than or equal to 40 indicates you are not a good. Multiply the total from step 2 by 100.

To get the percentage you multiply the. Back End Mortgage Ratio Total Monthly Expenses Gross Monthly Income 100. The back-end ratio also known as the debt-to-income ratio is a ratio that indicates what portion of a persons monthly income goes toward paying debts.

Calculate Your Debt to Income Ratio. New Ratio Needed. Historically lenders have preferred the front end ratio to be below 28.

Use our gear ratio calculator to find the effective gear ratio your vehicle will have with a new tire size. Front End vs Back End DTI. To calculate your front-end ratio total the monthly housing costs you expect to incur and divide that number by your gross monthly income.

This calculator shows your frontend backend debt to income ratios. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA limits are 3143 and the VA loan limits are 4141. The back-end ratio is a measure that signifies the portion of monthly income used to settle debts.

Lenders Lender A lender is defined as a business or financial institution that extends credit to. In this case ½. The calculation for the.

Also calculated is the new gearing you would need in order to return. How to calculate back end ratio. Thus the total debt payments for Sam are 1600 per month.

The ratio represents the number that needs to be multiplied by the denominator in order to yield the numerator. This is calculated by taking the total monthly housing costs by income before tax. Use this worksheet to figure your debt to income ratio.

You derive your backend DTI ratio by dividing your monthly housing expenses and other debt obligations by your monthly gross income. They can also be written as 1 to 2 or as a fraction ½. The total is your back end DTI ratio.

The lower the DTI the better your odds are for being approved for new credit.

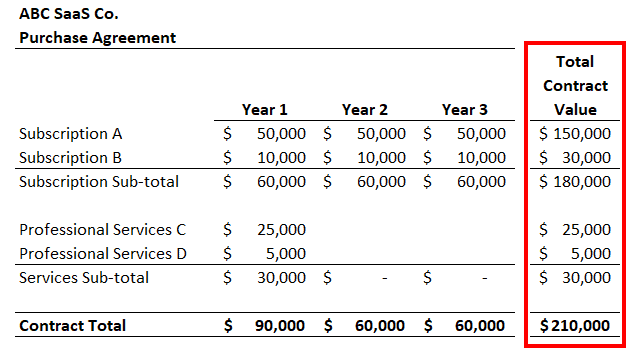

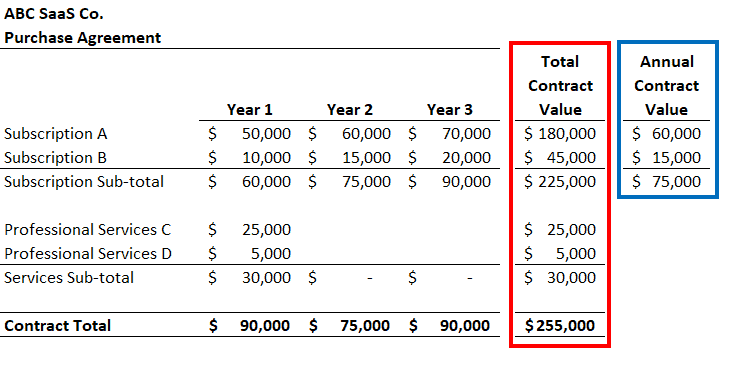

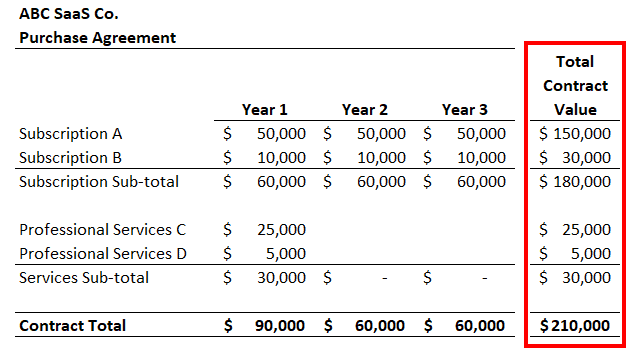

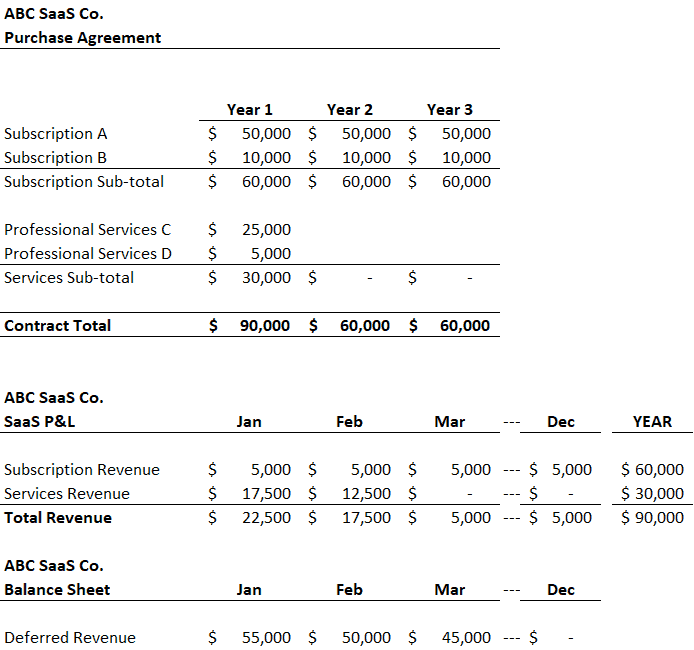

Bookings Vs Invoicing Vs Revenue The Saas Revenue Cycle Explained The Saas Cfo

Gear Ratio Calculation A 100 Tooth Gear Drives A 25 Tooth Gear Calculate The Gear Ratio Of The Mesh Mechanical Engineering Engineering Mechanical Gears

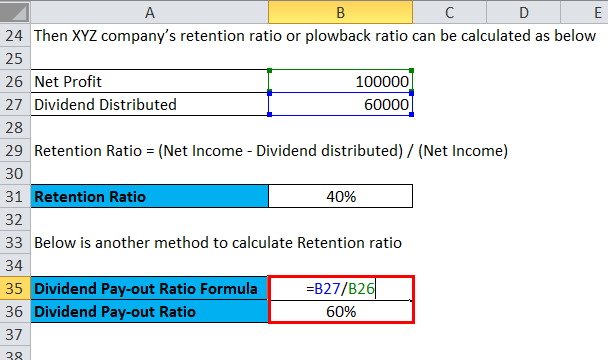

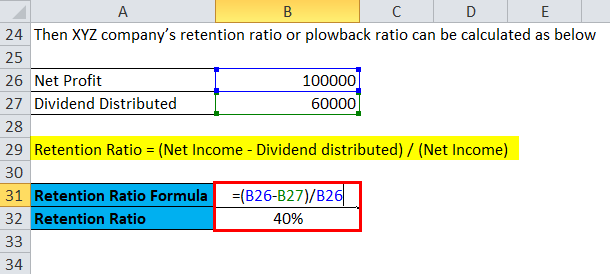

Retention Ratio Formula Calculator Excel Template

Mortgage Tips And Tricks Assumption Assuming A Mortgage Home Mortgage Mortgage Tips First Time Home Buyers

How I Earn Over 10 Passive Income With P2p Lending

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Blog Finding Financial Freedom

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Unlock Your Macro Type Identify Your True Body Type Understand Your Carb Tolerance Accelerate Fat Loss Hronec Christine 9780358576624 Amazon Com Books

Retention Ratio Formula Calculator Excel Template

Retention Ratio Formula Calculator Excel Template

Debt To Income Ratio Formula Calculator Excel Template

Bookings Vs Invoicing Vs Revenue The Saas Revenue Cycle Explained The Saas Cfo

Measure Your Financial Security By Calculating Your Debt To Cash Ratio

Measure Your Financial Security By Calculating Your Debt To Cash Ratio

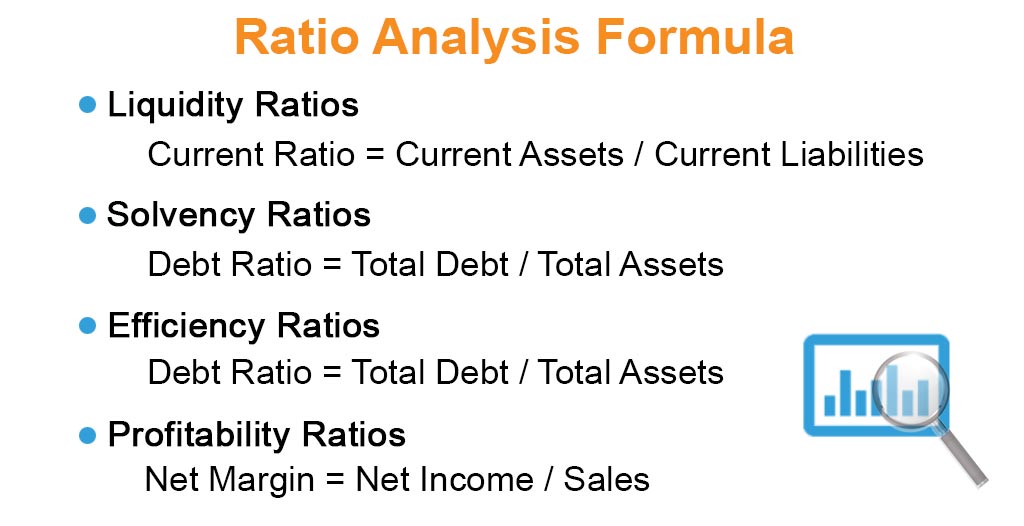

Ratio Analysis Formula Calculator Example With Excel Template

Bookings Vs Invoicing Vs Revenue The Saas Revenue Cycle Explained The Saas Cfo